“Happy Birthday, Higher Education Act – You Turn 60 this November!”

If someone asked you what the birth date of our profession was, what would you say? I think the consensus would say it was Monday November 8, 1965, when President Lyndon Johnson signed the Higher Education Act (HEA). The HEA opened college doors for thousands of new students that previously could not afford to attend. With newly created grants, an improved work study program and new low interest student loans, administrators were needed to oversee these programs at colleges and help students obtain this assistance. Those first financial aid administrators were the pioneers that laid the groundwork for the profession we know today.

One of my favorite television shows is “Finding Your Roots” hosted by Dr. Henry Louis Gates Jr. on PBS. If you are unfamiliar with the show, Dr. Gates helps celebrities trace their family trees back to learn about ancestors they never knew about. To fully understand why we do what we do today it is helpful to look back at the beginnings of what would become “financial aid”.

The Past

Even before the HEA was signed by President Johnson, the federal government provided students assistance through military training programs (WWI) and work programs (Great Depression). In 1944 President Franklin D. Roosevelt signed the Servicemen’s Readjustment Act, more commonly referred to as the G.I. Bill. It provided benefits to veterans transitioning into civilian life after World War II. It offered educational assistance, unemployment compensation, and low-cost home and business loans. Since it’s passage, the G.I. Bill has been amended multiple times, creating new slightly different versions such as the Post – 9/11 G.I. Bill.

This early aid was limited to a narrow range of students, but it provided a model and precedent for the federal government to expand aid to a broader range of students beyond veterans.

President Johnson sought to improve the lives of ALL Americans. He collectively referred to the pieces of landmark legislation as The Great Society. The key initiatives included the Civil Rights Act of 1964, the creation of Medicare and Medicaid to expand health care, significant federal aid to education, and programs like the Job Corps and Head Start to combat poverty. The Great Society also addressed environmental protection and consumer safety. The Civil Rights Act prohibited discrimination at places of education, and the HEA provided increased funding for Historically Black Colleges (HBCUs).

In January 1965, Johnson declared higher education a necessity, not a luxury, and sought to expand opportunities for students regardless of their financial background. Later that November on an unseasonably warm day in D.C. with temperatures reaching the mid-eighties, he made it happen with his signature.

The HEA also prioritized institutional accountability for student success and educational quality.

The early financial aid administrators found a much more personal job, almost exclusively working face-to-face with students and dealing less with government oversight. Administrators had the freedom to use professional judgement on a much larger scale.

Changing Times

The Higher Education Act is scheduled to be reauthorized every five years and is structured into different “titles”. Changes can be made to the HEA through amendments during reauthorization. From 1965 to 1980 several new titles were added. During the reauthorization of 1972 the Basic Educational Opportunity Grant (BEOG) was renamed the Pell Grant. The name was changed to honor of Claiborne Pell, a long-serving Senator from Rhode Island that championed access to higher education. The Supplemental Educational Opportunity Grant was also created at this time. Amendments in 1976 modifying the definition of “institution of higher education” to include vocational schools and extended authorizations for several aid programs. The rules governing student loans were also made more borrower friendly.

In the late 1970’s President Carter realized the need for a central department to oversee the expanding financial aid programs. So, although the Higher Education Act of 1965 did not directly create the Department of Education, it laid the groundwork for its creation by expanding federal involvement in higher education. The Department of Education became a dedicated Cabinet-level agency in 1980 to manage these growing programs, which the Department of Education now oversees.

HEA Titles

The act is structured into different “titles,” each addressing a specific area:

· Title I – Contains general provisions and defines the framework for the HEA.

· Title II – Provides funding and grants to enhance higher education library collections and teacher quality.

· Title III – Offers financial support to strengthen developing institutions that serve high numbers of minority and low-income students.

· Title IV – This is the heart of the HEA, providing student assistance through scholarships, low-interest loans, and work-study programs.

· Title V – Focuses on building programs for institutions that serve Hispanic populations and other developing institutions.

· Other Titles – Include provisions for international education programs, improvements to graduate and postsecondary programs, and other additional programs.

From its enactment in 1965 until 2008, the HEA was reauthorized approximately every five years. But the last comprehensive reauthorization was done in 2008, with the Act expiring in 2013. The HEA has remained in effect for the last twelve years through temporary extensions.

Some may ask why the HEA needs reauthorization so frequently. The purpose is to keep pace with evolving higher education standards, technological advancements, and anti-discrimination efforts. Reauthorization involves examining and renewing the law’s provisions, including federal student aid programs and federal aid to colleges.

Current Status

Several bills to reauthorize the HEA have been introduced in Congress over the years by both parties, but they have not been able to pass due to political differences.

Can the Higher Education Act of 1965 be reversed or completely nullified?

The HEA cannot be undone, but it can be dramatically changed through new titles and amendments during reauthorization. Old parts of the Act can be changed or repealed. Congress would need to pass a bill or series of bills to either reauthorize it with significantly different provisions or pass new legislation that effectively nullifies the old act. The HEA is an evolving law whose future depends on Congress and its reauthorization efforts.

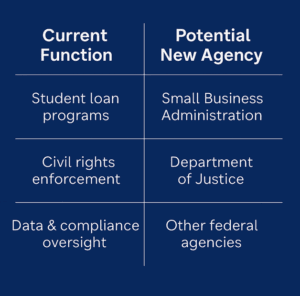

One of the most significate changes to higher education came last summer with the passing of what is commonly referred to as the One Big Beautiful Bill Act. This Act proposes changes outlined in the Heritage Foundation’s Project 2025 initiative. Project 2025 proposes to amend, significantly curtail, and privatize many core functions of the Higher Education Act (HEA) of 1965. The plan aims to drastically reduce the federal government’s role in higher education, moving federal student aid programs into a privatized, for-profit system and eliminating loan forgiveness initiatives.

The Future

Does this spell the end of the profession that was born on that warm day in November 1965? Do the number of candles on the birthday cake stop at 60? And is the Higher Education Act, that has survived for sixty years, worth fighting for and saving? The HEA continues to give millions of students access to higher education. Countless studies have shown that people with college degrees earn more than those without. Do we still want to strive for President Johnson’s Great Society?

What can we do as we celebrate the 60th Birthday of our profession? I think we follow the example that those first financial aid administrators set in the 1960s – adapt and move forward. Reassess the current needs and try to predict future needs. I am proud to be part of a company that is doing exactly that. My company, Financial Aid Services, presented our newest product – Financial Aid as a Service (FAaaS) – to the world last month. FAaaS will address the needs of colleges as financial aid administrators leave the school setting. The new FAaaS product can help schools navigate the changes of the One Big Beautiful Bill Act and assure that students remain the top priority.

To learn more about FAaaS visit our page: https://www.financialaidservices.org/financial-aid-as-a-service/

Shutterstock

Shutterstock